How chapter 7 bankruptcy can Save You Time, Stress, and Money.

to concur without supplying consent for being contacted by automatic implies, text and/or prerecorded messages. Prices may possibly use.

Nevertheless, you'll be able to unfold out the balance owed above 5 years if It could be much more economical. As with all Chapter 13 scenario, you'll need to demonstrate you have enough regular profits to generate the system payments. Find out how to compute Chapter 13 strategy payments.

It streamlines finances, which makes it much easier to observe and control payments while potentially improving credit history scores. In the long run, financial debt consolidation aims to simplicity economic load, offering a structured repayment system to help you people today get back control of their funds.

In this article, you’ll present tax returns, a program of belongings and debts and various financials. Whether you file a joint petition, you’ll also ought to report your wife or husband’s money details. Whatever they receive counts as house income.

Consolidating may also help you save you income on interest should you’ve enhanced your credit history rating considering the fact that having out your initial financial loans. Also, debt consolidation loans ordinarily come with lessen prices than charge cards.

A zero-percent system doesn't mean you are going to pay back practically nothing at all. But you won't pay out just about anything in your nonpriority unsecured creditors, such as bank card balances, professional medical and utility payments, and private loans. Any remaining financial debt you could discharge in Chapter thirteen is going to be wiped out at the end of your situation.

You'll should Dwell inside go to these guys this budget for as many as 5 years. Throughout that time the court will frequently Test your paying, and can penalize you seriously in the event you aren't next the prepare. Seem like find out this here exciting? To best it off, it will remain on your file for seven several years.

Declaring bankruptcy really should only be viewed as A final resort. With regards to the form of bankruptcy you file, you may well be necessary to promote your property, meet up with with (and respond to concerns from) the many individuals which you owe funds, live under a court docket-requested price range for approximately five years, experience a giant strike on the credit history rating, and discover it challenging to get a home, a vehicle, or a private bank loan for nearly a decade.

In place of getting many credit card costs together with other accounts to pay, normally with particularly large desire prices, financial debt consolidation reduces People go to the website individual debts into just one payment each and every month.

I'm a shopper bankruptcy attorney located in Alexandria, VA and I serve the requires of All those in Alexandria, Virginia along with the surrounding space. I am a solo practitioner which suggests which i will Individually deal with your circumstance from start out to finish.

You must talk to a bankruptcy attorney to check out if this can be done for you. Read A lot more Read through Considerably less Exactly what does health care financial debt impacts so far as my property are worried?

So as to finish the Formal Bankruptcy Forms that make up the petition, statement of economic affairs, and schedules, the debtor ought to compile the next information and facts:

Unsecured debts will check it out likely be long gone, but home loans and automobile payments could possibly linger. Hopefully, you’ll have formulated the practices required to meet People obligations.

What Products and services Does Lawinfopedia Supply? Lawinfopedia is devoted to linked here assisting All those needing free of charge or very low-Price authorized expert services. We generally gather two kinds of information to assist our customers remedy their authorized difficulties.

Luke Perry Then & Now!

Luke Perry Then & Now! Mr. T Then & Now!

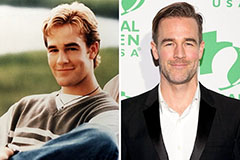

Mr. T Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!